Time:Apr. 29(Fri.), 13:30 -15:00 (Beijing Time)

Title: Price Elasticity of Housing Demand in China and Optimal Property Tax Design

On Zoom, scan the QR code for registration.

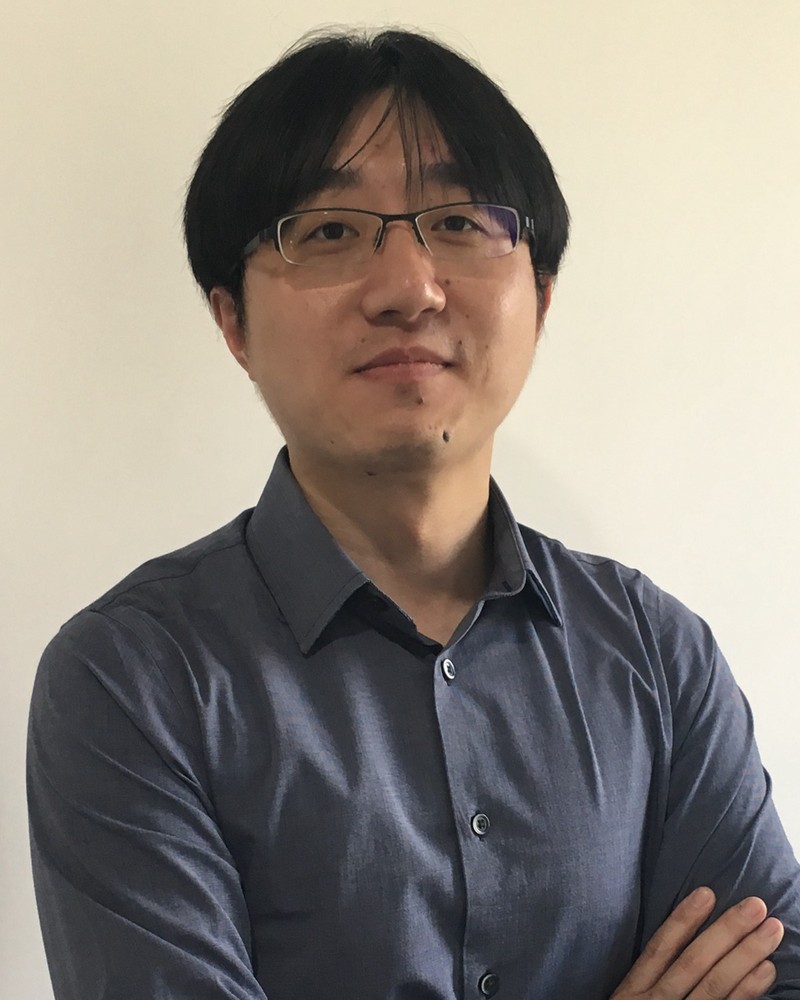

About the speaker:

Tong Xu is an Associate Professor of the Institute of Chinese Financial Studies at Southwestern University of Finance and Economics. He received his Ph.D. from Department of Economics at Emory University. His research areas include macroeconomics and finance, especially on financial liberalization, financial intermediation in the business cycle, and Chinese housing market.

Abstract:

China is going to launch the property tax reform soon, but there is still lack of consensus on its impact on the real estate market and how to design the reform. This paper proposes a heterogeneous household housing market equilibrium model, which is capable to calculate the effect of any given property tax design on housing market as well as its tax amount and tax burden distribution. The set of important parameters in the model come from estimation with micro data. First, based on the structural discontinuity of tax rate for deed tax in China, this paper estimates the price elasticity of housing demand with loan-level mortgage data and the bunching method. We find that the price elasticity of households’ residential housing demand is 0.169, while that of non-residential housing demand is 0.204. Second, we estimate the households’ demand preference distribution with household survey data. Then this paper calculates the equilibrium outcomes for various property tax designs. The results demonstrate the importance of considering the decrease of equilibrium house price and the change of households’ housing choices in the evaluation of property tax design. Finally, we show how to pick the optimal property tax design given government’s preference for stability of housing market and property tax income.