题目:Intertemporal Imitation Behavior of Interbank Offered Rate Submissions

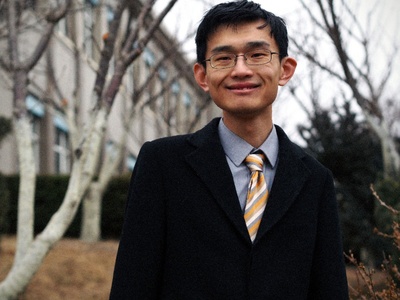

主讲人:孙航,东北财经大学

时间:2020年5月8日,13:30-15:00

举办方式:线上讲座

主讲人简介:

Abstract:

Using evidence from the Shanghai Interbank Offered Rate (SHIBOR), we show that some panel banks of an interbank offered rate system imitate peers' quotes after observing them on the next business day, which eventually leads to the predictability of the rate. To measure the strength of the imitation behavior, we construct a “Signed Active-minus-Stationary (SAmS)” Index, and show that the SAmS Index predicts SHIBOR changes. Moreover, the predictability of SHIBOR is not perceived and understood by the market. This causes the mispricing of SHIBOR-linked interest rate swaps, and, as a result, the excess returns of the interest rate swaps become predictable by the SAmS Index as well. Our findings suggest that the interest rate quotes can lose independence even without deliberate manipulation, which regulator should pay attention to in the supervision and reform of interest rate benchmarks.

报名方式:

非经济与社会研究院的师生需报名参加本次线上讲座,请感兴趣的师生扫码下方二维码报名,报名截止时间为2020年5月7日12:00。